Boosting growth and enabling scaling

We help companies to fine tune their strategy, enable acquisitions and identify funding opportunities. Services offered include Due Diligence, Fund Seeking and Advisory & Strategy Consultancy for management and board.

Our Services

Enhanced insights from business and technology viewpoints. Serving both investors and entrepreneurs..

Due Diligence – We bring clarity to your cases

With the due diligence process we help you to identify potential risks and opportunities within target company. Main focus of our investigation is on functional fit between desired business outcome and the chosen technology approach. The ability of the proposed team to deliver in terms of cost and time will also be thoroughly analyzed.

Need for funding – We help you to identify best fit

We are helping you to find best fitting source for funding and also the right instruments serving your needs and optimizing founders share. While identifying funding sources, we take care that they are aligned with your needs as combination of funds and support available. Cybermind also mostly invests in the companies it represents.

Advisory for Board or Management – We remove mist from your vision

With our advisory service we increase visibility into company during transformations or act as sparring partner helping Board or Management. Our vast experience combined with the innovative approach can help you to identify new opportunities for your business. Your success is our success.

Strategy Consultancy – We help you to finetune, clarify and create ability to execute

We help you to proceed with prioritized solutions to drive growth and create efficiency. We create customer-driven strategies and innovate new concepts to generate success. We are ready to meet the challenges of a data-driven world and help to develop your strategy and needed capabilities to needed level. Strategy process boosted for you Cybermind implements

Investment targets for Funds and VCs – We reduce your work load

We help our clients to identify interesting investment targets locating best matching opportunities to their portfolio structure and specified target company characteristics. Our individual approach helps your deal flow to become as optimal as possible thus reducing unnecessary time wasted on handling of not fitting candidates. Need new ideas for investment targets?

Valuation principles for start-up – 3 ways to validate your story

We offer you free questionnaire, which contains necessary information for validating your approach to the funding. Our comments based on the analysis can help you to avoid common pitfalls as well as to get rough estimate of the potential valuation of your company at its’ current state from point of view of the potential investors.

Team

Dr Jouni Selin, PhD, MSSc, MBA

Business, finance, technology, risk management and administration related operations, innovation and development. Extensive experience from strategy, development and transformation projects including major turn around programs. Operative roles CEO, CDO, CIO, CFO, CRO, CLO, CCO. Board and advisory roles in international companies.

Seppo Heikura, MSc, MBA

Strategy, marketing, innovation strategy and funding focusing to data intensive businesses. Business development, change/transformation and efficiency programs. Operative roles CIO, CTO, CDO, CMO. Board and advisory roles in technology focused companies in Nordics.

Consulting – tailored to your needs

Contact us and our experienced partners drill into your challenges locating ways to speed up your growth or tackle the barriers within your existing business. We figure out optimal connection between your your strategy and capabilities needed for successful implementation.

Our approach is matching to help board of directors or management from advisor point of view. Helping you to find the best of your company whether it is a start-up or already more established one.

Free whitepaper about start-up valuation

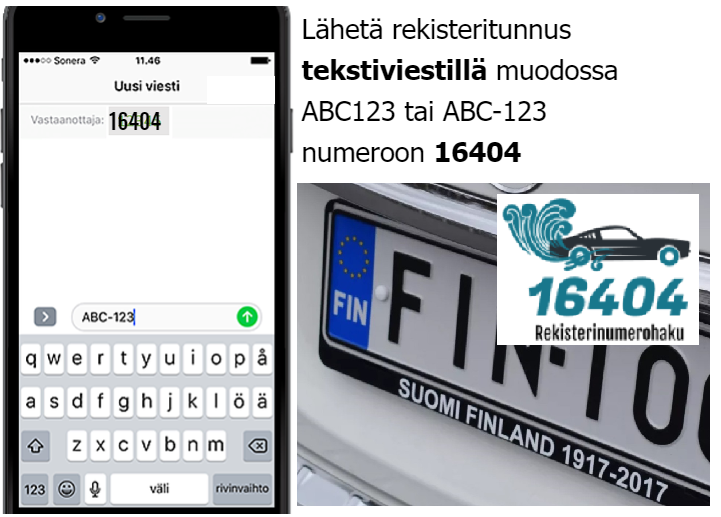

Digital services – Search for vehicle information from Traficom database